How to Plan a Big Family Christmas 2025 on Poor Credit?

Christmas unites families despite a tightening of the purse strings. Bad credit scores complicate that time of year. Millions of households in the UK struggle each year with financial resources and festive hopes. You can begin your strategy several months before December.

Most use doorstep loans on benefits for some emergency buys during the festival. They can be good when used carefully for small sums. The payment is easy to fit with friendly agents who come weekly. They usually understand your circumstances and are willing to give flexible terms. You ensure they are fully licensed and provide clear cost details before you sign.

You can avoid the debt trap that destroys January by planning. You can have a warm and wonderful Christmas 2025 in this way.

How to Plan a Big Family Christmas?

Christmas brings joy, but can strain tight budgets. You can host a wonderful family Christmas without crushing debt.

Establish a Realistic Budget

First, look at how much you can afford. You put all your monthly income against standard bills. The amount left over is your Christmas fund. You can split this between gifts, food, decorations, and treats. Be realistic about how much you can spend. Most lenders have special Christmas savings accounts to help you save. You should never use payday loans, as their high interest rates can lead to significant problems.

Shop Ahead of Time for Bargains

Black Friday is not your sole opportunity for discounts. You can begin seeing deals months before December arrives. You can access programs such as Vouchercodes or Hotukdeals to get price reductions. You can enrol in reward programs at stores you frequent. You should purchase non-perishables when they are at discount prices, not when you require them. Most stores offer discounts on Christmas products in January.

DIY Gifts & Décor

Homemade gifts are more personal than gifts purchased at a store. You can bake cookies or jam for inexpensive, thoughtful gifts. You can paint pinecones into holiday decorations. You can look up YouTube, which has an endless supply of easy craft tutorials.

| Method | Savings Potential | Example |

| Shop off-season sales | High | Buy décor in January |

| DIY gifts | Medium | Homemade candles, or food jars |

| Cashback apps | Low–Medium | Quidco, TopCashback |

| Free events | High | Council Christmas markets |

| Gift swaps | Medium | Secret Santa with a £10 limit |

Share Costs

Christmas does not have to be paid for by one person. You can invite the family to contribute a dish or beverages to share. You can organise a secret Santa where everyone contributes only one good gift. Organise free things like walks, board games, or Christmas movies. You can discuss money limits openly – the majority of relatives will be fine with it.

Monitor Every Expenditure

You can save receipts and record every purchase in a book or app. Keep a small emergency fund for things you forgot. You review your account balance regularly to prevent nasty surprises. This builds improved money habits next year.

Getting Loans While on Benefits with Bad Credit

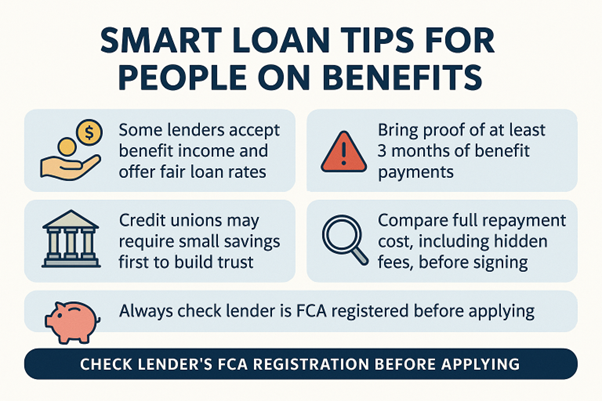

Some lenders work with people who receive government help. They know benefits provide a steady income, which matters more than credit scores to them. They often offer the best deals for people in tough spots. They charge much lower interest than high street banks. Most need you to save a bit with them first before lending. This builds trust and shows you can manage small amounts.

Bad credit loans for benefit claimants do exist, but watch for high costs. Some companies target those on benefits with flashy ads promising quick cash. You always check if they’re listed with the Financial Conduct Authority before you apply.

You bring proof of all your benefit payments when you apply. Most want to see at least three months of steady income. You can take your Universal Credit, PIP, or ESA. Never use loan sharks who ask for cash payments. These often trap people in debt cycles that grow worse over time.

You compare the total cost you’ll pay back before signing any loan deal. You can look beyond monthly payments at the full APR. Many loans hide fees in small print or charge for early payoff.

Managing Christmas Costs with Poor Credit

Christmas cheer shouldn’t mean January financial regret. The store cards may sound convenient, but their interest rates tend to be 30%. Payday loans may boast more than 1000% APR, making small loans into massive ones.

You have to remain committed to strategies that do not accrue new debt. Debit cards are good if you monitor your balance regularly. Prepaid cards allow you to put on board only what you can afford.

Some companies offer Christmas loans on benefits with soft checks. These can help spread costs, but check terms closely. They often have fairer rates than high street lenders. You can start buying small gifts from September onwards to ease the December strain. You can put aside £10-20 weekly if possible. Many shops hold early sales before the main rush begins.

Most stores and banks give cashback deals. They give money back on everyday shopping. Supermarket points can be redeemed for triple at Christmas. Some reward cards allow you to accumulate points throughout the year for seasonal shopping.

Christmas Budget Tips

- Use the “four gift rule”: something they want, need, wear, and read

- Try homemade food hampers instead of costly presents

- Shop at charity shops for nearly-new toys and books

- Check Facebook Marketplace for local bargains

- Host potluck gatherings where everyone brings one dish

Saving for Christmas 2025 All Year Round

Most banks have savings areas in your current account now. You can label these “Christmas 2025” and arrange to transfer small amounts each week. A £2 a week turns into more than £100 by December. Some credit unions operate Christmas clubs where your cash remains locked away until Christmas.

You can have a go with the envelope technique – deposit loose change into a label or designated envelope every week. Others round down their bank balance and set the spare pennies to the side. This accumulates savings without feeling the pinch too severely.

Your house probably has secret money in items you do not use. Your old phone, games, clothes, or toys can get a second life on the internet. Facebook Marketplace has no commission, but eBay sells to the most consumers. The proceeds go directly into your Christmas sales.

| August–December 2025 Christmas Savings Tracker | |||

| Month | Saved (£) | Side Hustle Income (£) | Total (£) |

| August | 20 | 15 | 35 |

| September | 20 | 25 | 45 |

| October | 20 | 30 | 50 |

| November | 20 | 20 | 40 |

| December | 20 | 10 | 30 |

| Total | 100 | 100 | 200 |

You can keep your gift list tight and focused. Your kids might prefer one good present over lots of small ones. You can consider gifting time or skills instead of objects when possible. A promised day out or help with a project costs little.

Conclusion

There is no reason your Christmas has to blow its budget or your credit rating. You can start today by starting a basic savings account or putting aside coins weekly. You discuss openly with family members what is important during your time together.

You can make paper chains, cook simple foods, or fashion homemade cards with your kids. You can budget meals on lower-priced foods that are in season and scan for lower-priced items. You just remain firm when stores promote credit offers with enticing discounts.

Paul Smith is an established financial author and writer with over nine years of experience, who specialises in personal finance, loans, credit management, and investment strategies for people throughout the UK. Paul’s expertise can be seen on leading loan websites such as Bargainloans. Through his blogs and articles Paul has helped thousands of borrowers make wiser financial decisions while his passion for study encourages people to take control of their finances with greater confidence and clarity