Financial emergencies that come for a temporary period are usually recurring. Every now and then, you may need additional funds for one reason or another. This additional requirement can disturb your budget. If you do not have sufficient funds, it becomes vital to depend on external sources of funding. 12-month loans are a short-term loan solution that can easily and quickly fulfil all kinds of urgent and small-amount requirements.

These loans can fulfil car repair, home renovation, medical emergency, or any need for which you want funds. If you depend on direct lending solutions, it becomes even easier to get funds quickly through a paperless process.

Bargainloans offers funds on instant decision. We ensure fast fund transfer by using new-age lending technology and uncompromised data privacy. Through us, you can get a loan for your small needs fast. If you are struggling with any financial emergency, apply now without a guarantor for customised loan deals. Also, no obligation is required. Get 12-month loans with no guarantor based on your ability to pay back.

It is a short-term personal loan offered in the UK loan market. The loan is repaid through monthly instalments over a period of 1 year or 12 months. They are cheaper than 12-month payday loans, making borrowing an easy journey.

Due to the multiple benefits of 12-month loans, these have become the preferred choice of fund seekers. They have found those benefits to be quite effective in this short-term loan solution over other options.

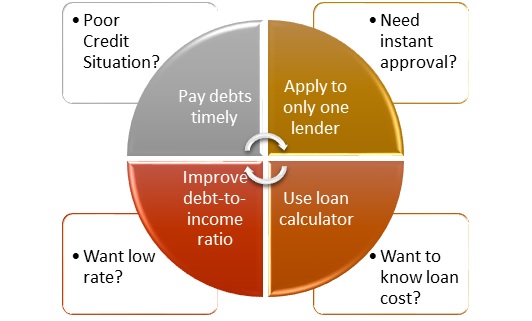

12-month loans are also available to borrowers with bad credit conditions. You can easily find the best deals online for 12-month loans for bad credit. Direct lending is all about making things convenient and offering funds in easy instalments. However, bad credit loans have certain specific features that differentiate them from other loans. If you plan to apply for a loan with a less-than-perfect credit report, you must know about these features.

A bit of a higher interest rate

Due to a poor credit situation, funds are available to you at a higher interest rate. This is because borrowers with less-than-perfect financial records often have a higher risk profile for lenders. In such a situation, funds are provided to you at a higher interest rate to compensate for the insecurities on the part of repayment.

No mandatory obligations

It would be wrong to think that applying with a poor credit rating would require you to provide a guarantor or collateral. We offer 12 month loans for bad credit with no guarantor with attention to your financial limits to repay. As long as you can show regular earnings to make timely repayments, getting a loan is possible. Sometimes, borrowers can only bring a guarantor or collateral with the borrower's consent.

Chances of improving credit scores

At Bargainloans, any obligation is not compulsory in the loan process. The most significant advantage of these loans for bad credit is that if you make timely repayments, you can improve your credit score. Many borrowers use these loans to overcome money crises and improve credit ratings. We report your improved financial behaviour to credit reference agencies. In this way, with every timely instalment, your credit rating rises.

This offers you better loan deals and financial products in the future. Along with this, your financial life stabilises again. Stop thinking and apply right now for a 12-month loan for bad credit with no guarantor from a direct lender. We can be your next direct lender. Call us or submit an application to get instant approval.

The application procedure for personal loans for 12 months is completed online. The money is disbursed to your account within 24 hours, and you can use the money for any purpose, including financial emergencies.

We are committed to responsible lending. We provide all types of short-term loans with tailor-made offers to deliver instant financial relief to borrowers. We make certain important factors a part of our loan policies. This is our approach to offer borrower-friendly loan solutions. This is why, over the years, our borrowers have been satisfied with our services, and now, for their future needs, they choose us every time.

Short-term funding has only one aim: if you choose a direct lender, that is funding faster than you can imagine. Fulfil any financial needs that are too many through smooth borrowing procedures and affordable loan offers. Your approval to instant decision loans for 12 months is a few minutes away.

Yes, you need one because, after approval, we need to transfer funds. Also, to check your repayment capacity, we need your bank statement. Therefore, having a bank account is a vital need. However, if you apply for a doorstep loan, we approve funds even for those without any official bank account. That includes providing loan money in cash at the borrower's doorstep. Still, you should have a bank account.

Simple conditions are sufficient to get a loan for 12 months. These are -

When the tenure of a 12-month loan ends, it goes through the following steps –

Yes, you can definitely apply from your mobile, as direct lending loan procedures are handy and mobile-friendly. Also, the complete loan process is digitised to ensure convenience for the borrowers. You can apply it from your mobile device during your daily commute while sitting on your couch or doing anything. Gone are the days of bulky paperwork with the compulsion to be physically present at the banks.

According to lending rules, you have a 14-day window to cancel the approval or loan offer. For that, you don’t need to mention a reason. You can contact the loan provider company. Cancel the offer in writing, either through e-mail or letter. However, it is important to get proof of loan cancellation. Keeping the process clear and legal is vital to avoid any complications against you.