Personal financial needs are unpredictable, and therefore, they can put you in a fix anytime. What’s the solution? The popular loan solution is perhaps getting personal loans. In fact, it is the most relevant solution. Whether it is a medical emergency or an unplanned travel, this option is dependable due to multiple factors.

Direct lending makes borrowing funds easier with speedy online procedures for these sorts of short-term loans without guarantor requirements. Bargainloans offers personalised deals to its borrowers to ensure pocket-friendly deals. With a stable repayment capacity, you can avail yourself of funds in a few hours.

We vouch hard to provide you with almost the guaranteed loans without guarantors. These are backed by our salient loan features, including:

An unsecured personal loan online is known for providing financial support to fund seekers in desperate need. Due to multiple benefits, they choose these loans and always get satisfaction in return.

The new-aged finance industry offers a flexible and friendly atmosphere to the borrowers. That's why, nowadays, it is possible to get an unsecured personal loan for poor credit online. To do so, you need to meet certain conditions. As a direct lending company, we need to check every applicant's affordability. For that, the following aspects play a vital role.

With these ways, you can easily get funds for any duration, from 12-month loans for poor credit to a loan with 3-year tenure. It depends on how well you manage your personal finances. Also, follow the precautions while applying for funds.

The type of personal loan also changes according to the rate of interest. Majorly two types of loans are available. Fixed interest rate loan and variable interest rate loan. Both sorts of deals are available at Bargainloans, whether it is an instant 24-month loan or any other duration.

Fixed-rate personal loans - In this type, the interest rate remains the same throughout the tenure. This is why repayments remain the same and unaffected.

For example, a fixed rate on a £3000 personal loan if the tenure is three years at 10% APR. The monthly instalment will be £97, and the total repayment will be £3,492.

Variable rate personal loans - This version shows varied interest rates during tenure as per market conditions. This is why they have a higher risk of bulky repayments.

For example, a variable rate on a £3000 personal loan if the tenure is three years at the current 10.75%. It may change in the future. The monthly cost will be £97.98, and the total repayment will be £3527.28. This total amount can increase or reduce considerably when the interest rate changes as per market conditions.

Whenever you apply for a loan, you want to get approval as soon as possible. Only in that way can you receive funds on time. Every second is important during a financial emergency. If you want instant approval, follow the tips below.

We are committed to providing the best loan solutions to our customers. For that, we try to improve your borrowing experience in every way possible. Following are the reasons why you may choose us for affordable loans.

Bargainloans has been active in the direct lending sector for years. We have helped thousands of fund seekers manage their money crisis through speedy, affordable, personal, instant 24-month loans. Whether you have good credit or poor credit score, we approve your funds easily.

With a liberal approach, we try to lend funds to as many people as possible. Even to those with no current employment, our loans are available as per their payback capacity. If you are struggling with a financial crisis for any reason, we can be the reason to bring mental peace to you.

Fulfil a few conditions, and you can qualify to borrow money easily.

A personal loan can be used for many purposes, such as -

There is no restriction on how you use the borrowed money. Whether you apply for an unsecured personal loan of 5000 pounds in the UK or a personal loan for 10000 pounds, flexibility is available in all cases. After you receive funds, use the money either for one or multiple purposes.

Yes, you can always repay loan early. However, there can be a lock-in period. This means that after taking the loan, you cannot make repayments for a certain period, like 3 months or 6 months. But after that, repaying the loan is possible. However, some lenders take early payment penalties, but not all. At Bargainloans, we let you repay early without any charges or penalty.

The maximum repayment term is seven years. However, what tenure you will get depends completely on your credit purchase power. This is the maximum time available to repay funds. Get a free loan quote today with a soft credit check and know your tenure. In this way, you can plan your budget well for the loan repayments.

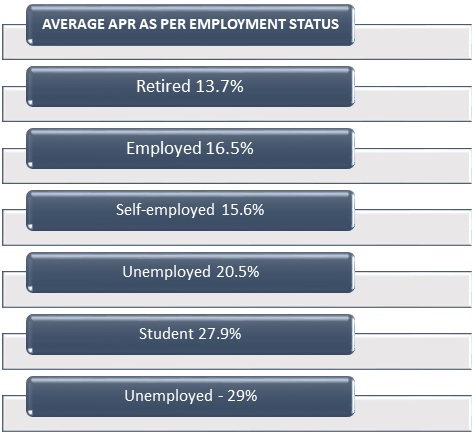

No, there is no discrimination based on employment status. As long as you have a strong payback capacity, getting a lower rate of interest is possible. Interest rate is mainly about your recent payment record and future financial circumstances. The more stable you are in terms of financial status, the more flexibility you get in the case of the rate of interest.