Loan solutions these days serve versatile financial needs. The best illustration of this is indeed 24 month loans from direct lenders. These can be used for any purpose through easy online loan procedures. All is due to direct lending that makes borrowing fast and convenient.

The loans are suitable for short-term to mid-term needs. Also, there is no constraint to borrow only for a specific purpose. Not only this, you do not need to bring a guarantor or pledge asset as collateral.

Your individual repayment capacity is the primary factor that helps you borrow funds. As per your repayment capacity, get approval on the loan amount. The tenure, monthly installment, and interest rate follow as the evident consequences.

Bargainloans commits to lend responsibly to everyone in need of funds. We approve 9 out of 10 applications irrespective of employment and credit score situation. Only you need to provide sufficient documents to prove you are earning enough to get and pay back a loan.

Get a free, no-obligation loan quote and see how much you can borrow from us.

As the loan term predicts, a 24-month loan is a short-term loan available for 2 years. These are personalised loan solutions offered to fund seekers based on their credit purchase power.

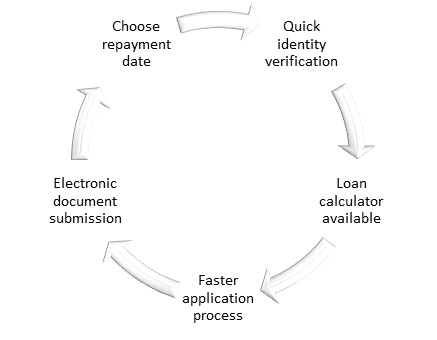

These loans are cheaper than 24-month payday loans despite no brokers’ involvement. You must repay the loan on your next salary date using payday funding. Obtaining these loans from a direct lender like us makes the borrowing journey convenient. 100% online procedure and instant approval ensure you get funds on time. You can always track your application status as we keep things transparent.

- How do 24-month loans work?

The application process is completed in three simple steps, i.e., 1) Apply Now, 2) Get instant approval decision, and 3) Receive funds after approval. For the convenience of borrowers, we auto-debit instalments. This removes any chance of delay or skip of repayments that may affect your credit score.

We also offer free quotes for 24 month loans with no credit check. Apply now and see how fast you can borrow money.

Multiple reasons convince fund seekers across the UK to depend on loans for 24 months. Their features offer flexibility and financial support and give sudden mental relief. The loans with the following benefits are available to individuals and business owners.

Financial Flexibility

Easy Access to funds

Good impact on credit

Use for varied purposes

Customised and flexible

With new-age lending solutions, getting a loan with a bad credit score is possible now. However, you have a risky credit profile due to a less-than-perfect credit report. Therefore, several conditions you must need to fulfil to get the loan. Once you do that, getting 24 month loans for bad credit with no guarantor is also possible.

Work on your credit purchase power

Depending on your credit situation, it may be difficult for any lender to be sure about your repayment capacity. You must work on your credit purchase power to prove you can repay the loan. Compared to a good credit score borrower, you have to justify your financial strength to bear a loan.

Income stability is a decisive factor

You need to have a stable income which helps you in getting your loan approved. Using this factor, you can prove turn things in your favour. Hence, make sure that you submit your income proof with complete accuracy. Income status of recent six months to one year plays the most important role.

Avoid job switches while applying

You cannot get 24 month loans for bad credit for long terms. Hence, in short-term loans, recent financial and employment circumstances act decisively. Do not switch jobs while applying for a loan. This may lead to loan rejection. Avoid it by staying in the same job. If you have been employing at your current company for years, it can help you get a lower rate.

The 6-month bank statement should show improvement

It is necessary to provide the bank statement for the last six months. This shows your earnings and financial behaviour. It is essential to mention that your bank statement must show the bills and debts paid in recent months on time. Funds can be approved for you only if your financial behaviour improves.

Show additional income (optional)

If you have any additional income, it shows you can be eligible for a larger amount. At the same time, it also gives you a strong support system to bargain on the interest rate. But these conditions do not necessarily apply. This is an option to get more flexibility in 24 month loans for bad credit with no guarantor from a direct lender online.

Despite rational approval rules, we follow several lending rules that ensure flexibility for borrowers. Our primary aim is to offer instant decision on 24-month loans with the least fear of rejection.

We offer budget-friendly installment loans without guarantor to borrowers from all walks of life. We only consider repayment capacity when considering the need for a flexible borrowing atmosphere. Fair credit score, poor credit score, employed, self-employed, freelancer, we accept all.

Following the lending ethics rationally, Bargainloans only wants to see your efficiency in paying back the borrowed money. Even the purpose of a loan is not asked when you apply. Hence, we are right here 24x7 to lend you 24 month loans responsibly.

The cooling-off period lasts 1 to 3 days after fund disbursal. You can exit the loan but you have to pay back the principal amount you have received from the lender. The interest rate will be reduced but the applicable part of that needs to be paid off. This is because right after the fund transfer, rate of interest applies and the borrower has to pay back the necessary costs.

Yes, you, but approval decision depends on individual cases. Some lenders may not accept such applicants. However, at Bargainloans, we do accept despite a past record of missed payments. But in that case, scrutiny of repayment capacity, payment history can be more rational. Usually, for a short-term loan, last 6-month to one-year credit history is sufficient. In case of missed payments in past, we may need to study more about your finances.

Of course, it is always possible to negotiate on the rate of interest, especially for existing customers. But your personal financial factors, too, are always decisive. The following factors matter for the negotiation -

Simply put, the more you work on your credit purchase power, the easier negotiating is.

No, at least at Bargainloans, there is no early repayment penalty. Some lenders charge this, which you should always confirm when taking out a loan for 24 months. But we aim to make affordable loans available to majority of people across the UK. This is why, if you decide to pay off your loan before the tenure ends, we just need few formalities but no penalty.

Yes, you can. The minimum age criterion is 18 years. Anyone from student to scholar can apply for 24-month loans without hesitation. Don't forget to work on your repayment capacity because that is the primary factor for approval. Besides that, there is no constraint on borrower type. Anyone can apply, from a student to a pensioner.