Financial support that you receive on time during an emergency is always precious. Obtaining it through a loan has become easier in recent years through direct lending. Get a 3000 Pound loan through a simple, predictable online process that eliminates unnecessary paperwork.

During an emergency, it can be painful to depend on the method of social borrowing. Asking for help from others makes you compromise your financial privacy. It is time to borrow money responsibly and repay it on affordable terms.

Bargainloans offers £3000 loans with instant approval decisions and personalised loan offers. It means you get approval for a loan amount, interest rate and tenure that you can afford financially.

End your search for the 3000 pound loan with no guarantor from a direct lender here. Get same-day funds without going through any lengthy process. Even if you are applying with a less-than-perfect credit rating, we will approve as per your creditworthiness.

3000 pound loans are short-term borrowing options that let you avail funds for instant needs. These are provided for a short tenure, and every borrower receives a different loan offer due to customisation. Therefore, the loans are always affordable with budget-friendly interest rates and repayments.

No obligation of guarantor or collateral is required to borrow money. Any applicant with a regular income and stable financial status in the past six months can apply. This prevents delays in loan procedure, providing the funds faster within a few hours.

Features of Pound 3000 loans are -

Due to all the above features, borrowers usually opt for a year term to repay £3000. Therefore, you can apply for 12 month loans for the same amount. However, your repayment capacity should be very strong. Borrowers with a good credit score who can afford large instalments apply for this tenure.

An instant decision loan for 3000 pounds works through an online process. This process takes only a few steps, and once approved, the money will be transferred into your account.

Getting a £3000 loan despite a less-than-perfect credit history is quite a possibility here. For that, you do not have to provide any guarantor or pledge an asset. You have to provide sufficient proof of creditworthiness for a £3000 loan for bad credit. Right after that, you receive approval and can get funds in your account.

A few factors play an essential role when you apply for a loan with a low credit score. Firstly, it is vital to have a regular income. Not only that, but employment stability is also a critical aspect. You must have been working with the same organisation for at least the last six months to one year. Additionally, the payment record for recent bills over the past six months should be paid on time.

Based on your improved financial behaviour, we lend you money through easy terms on a 3000 poor credit loan. Therefore, it is vital to prove that you have improved your capacity to pay the bills and other debts timely. It gives us a strong reason to accept and approve your loan request.

Can I apply for Pound 3000 loans with no credit history?

Yes, you can apply for the loans without any credit history. In fact, in that case, we can consider your application for pound 3000 loan with no credit check upfront. You can borrow money on tailor-made deals with pocket-friendly repayments. Pay the instalments on time and build a credit history. This improves your financial future, as getting loans in the future becomes simpler. However, the condition of providing regular income proof with stable finances is the same in both cases, with or without a credit history.

What if I want a bigger amount than what I pre-qualified for?

When you pre-qualify for a loan, it is simpler to know the amount you can qualify for. However, if the pre-qualified amount is not the maximum, try some alternative methods. Here are some tips to be eligible for the maximum amount of an installment loan of 3000 pounds.

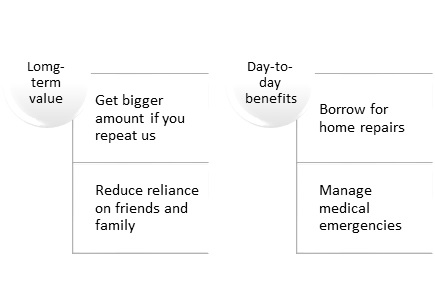

Due to the liberty of using a £3000 loan for any of the following purposes, this financial solution brings many benefits. You can keep counting as there are many. Several common loan benefits are mentioned below.

We work hard to provide you with the most affordable loan options. This is why most people looking for £3000 guaranteed loans from another direct lender ultimately choose us.

Bargainloans offers practical loan solutions, designed to meet your individual circumstances. Even if you apply for £3000 loans for people with bad credit scores, flexibility is available. Our primary goal is to approve as many loan requests as possible. Hence, if you need a small amount that can be of great importance to you, we are here.

Your repayment term is according to your repayment capacity. However, you can also choose your repayment date and the way to pay monthly, weekly, or bi-weekly. The term of a loan is something that is always as per your creditworthiness. Sometimes, due to issues in the financial past, you may not get the desired type of tenure.

A standard bank account is required to receive the loan amount after approval. The account must be in your name with a valid account number. The account should have features for electronic transfers. The name mentioned on your bank account should match the name in your loan application. It should be an active account.

You can face the following consequences if you fail to pay the loan.

At Bargainloans, we help you work on a new repayment plan. It helps you affordably pay the instalments. Before our borrower reaches the condition of default, we provide all necessary support. However, for that, the fund holder must inform us about the financial issues promptly.

Yes, it is available for everyone, from students to scholars. Anyone fulfilling the minimum age criterion of 18 years can apply for the loans. Also, the basic repayment capacity will be checked. Accordingly, anyone can apply for the Pound 3K loan for any purpose, irrespective of employment or credit score status.

Yes, the funds borrowed through the loan can be used to pay off credit cards or to manage any expenses. The loans have no purpose constraint. Many of our borrowers apply to eliminate their credit card debt, as the interest rate on these cards is relatively high. Once you get the funds, you can use it for any good reason.