You go to a store to buy groceries and essential cutlery. You invest time in choosing just the right set that meets your taste and standards. You proceed to check out, but “credit card reveals 'limit exceeded.” It may prove devastating and confusing. Here, experts at Bargainloans provide immediate relief with a loan of 4k pounds.

You don’t need to panic and leave the much-needed cutlery set. It is because the amount helps you fund the exquisite cutlery without compromising on other grocery items.

We don't need a detailed explanation regarding the loan purpose. We help by providing the cash within 30 minutes with no ifs and buts. Get the loan with minimum hassle, and ditch the lengthy and confusing documentation for quick cash. We may be the right choice if:

You may now get loan rates tailored to your needs and affordability. Bad credit ratings are not a barrier to us. Contact us now for a streamlined experience.

A loan of 4000 pounds is an unsecured financial facility for planned and unplanned expenses. You can use it to bridge the cost of buying furniture or repairing a broken glass table. Unlike secured loans, it does not host lengthy loan processing, asset, credit checks and documentation.

The loan comes with same-day processing and funds sanction. Anyone with a basic monthly income of over £800 may qualify. If the primary income is less, provide a valid secondary source.

One can repay the dues in easy and fixed monthly instalments by choosing loan terms as per financial affordability. Picking a long-term loan may mean paying more interest in total. Usually, you may get loans for 4000 between 12 and 36 months of repayment. However, one may check an extended term under seasonal earnings. It helps the borrower manage the repayments without defaulting.

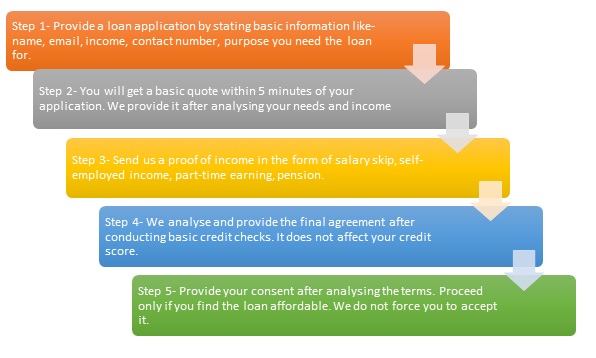

Anyone needing basic money to meet requirements, contact us. The procedure is smooth and easy to navigate by even a first-time borrower. We try to make things simple for you to apply without worries. Moreover, the constant assistance over call and chatbot helps you follow the steps with ease. Here is how to get 4000 pound loans without worries:

You may use 4000 pounds for any basic personal and business needs. It could be treating backsplash, paying bills or financing emergencies. Apart from this, the loan boosts financial health. Individuals seeking car loans, mortgages and credit cards may benefit from this. Here is how our £4k loans may reinstate your finances:

Consolidate debts and save money

If you struggle to keep up with monthly payments, consolidation may help. You can merge heavy debts into a single payment per month. It reduces total interest costs, monthly loan payment costs and the total amount to repay.

For example, you can merge credit cards, payday loans, overdrafts and other costly bills respectively using £4000 loans. It is if the total amount of such debts does not exceed £4000. It optimises your profile and increases credit utilisation. You can see a quick jump in the credit score.

Pay off a costly credit card debt

Usually, credit card accounts for the most expensive bills that you pay monthly. Non-repayment leads to interest costs and penalties. If you struggle to repay the credit card debt, the loan may help. Get rid of it immediately to pursue your life goals.

If you are struggling, we may help you choose the credit cards that you must pay first. Accordingly, you may get a loan quote. Alternatively, if you have a balance that’s less than that, for example, £2000, you can consider 2k pound loans. Yes, we have something for every cash need. Contact us to know in detail.

Flexibility to repay in 3 years

Do you have a low monthly pay but need a loan? Don't worry; we offer instant loans for every income. Moreover, you may spot the flexibility to repay the loan in long-term and small instalments. You just need to be regular with the fixed monthly payment.

For example, you may get installment loans for 4000 over 3 years of the repayment term. It helps you spread a small amount over a long term. If you borrow £4000 for 36 months (3 years), here is how your payments may look:

| Parameters | Cost |

|---|---|

| Monthly payments | £122 |

| Interest costs | £413 |

| Total costs | £4,413 |

Note: Repaying the loan within two years is cheaper than over three years. You should factor in interest costs, monthly bills, and outstanding debts before deciding on the term.

Getting 4000 with a low credit history requires you to consider a few aspects. Your profile reveals financial mismanagement. Therefore, taking a loan without due diligence may affect it further. Here are the clear guidelines that we offer to every individual applying for a 4000 loan with bad credit for the first or the umpteenth time. Going through this will help you approach the loan the right way.

It subsides any fears of disapproval or defaulting on the loan. We prioritise our customers’ financial well-being before profits. It is the reason we curate our guidelines periodically. Here are some aspects to consider:

Are my savings enough to meet the requirements?

Identify the purpose for which you need a loan and the savings. If you have a sufficient amount with no particular goal attached to it, you should avoid borrowing in that case and use that savings. Alternatively, if your savings source falls low of £4000, consider the loan. It helps you bridge your cash needs anytime and from anywhere.

Is this the cheapest quote that I can get?

It is generally ideal to check options before getting a 4000 loan in the UK marketplace. You can do that by pre-qualifying and understanding the basic loan quotes. Check the interest rates, APR, total amount to pay, loan costs, missed payment fees and other expenses.

Fetch the one with the lowest APR and interest rates. You do not need to go anywhere as we may help you from scratch. You may spot options to lower the total interest and the loan costs.

Is there any upfront fee on the loan?

An upfront fee is the cost that a loan company asks for before providing the final agreement. Not all reputed providers charge one. For example, you don’t pay one when you partner with us for an urgent loan. We are proud of keeping the terms and the costs transparent.

It helps you understand the payment structure and decide accordingly. Eventually, you can save money on a 4000 loan for a bad credit agreement. Always read the terms in small print mentioned at the end of the loan structure.

Yes, apart from four-thousand-pound loans, you can bank on us for other aspects, too. We host a variety of products to suit every requirement. No two people have the same financial status, credit score, and debt count.

Therefore, we experiment, curate, and launch different aspects. You may get it each personalised to your needs, financial affordability, and repayment flexibility. Here are some products to check on as an alternative:

1000-pound loan

It is the smallest loan amount that you can get with us. You can use a £1000 loan for your needs. It is helpful for important payments like utility bills, examination fees, groceries, etc. The interest rates are more competitive than a 2000-pound loan. However, you eventually pay more for the latter.

2000-pound loans

It is ideal for extremely small but urgent requirements. It could be fixing a lamp, replacing the door knob, or recharging the mobile subscriptions. It is an unsecured loan that holds a competitive interest rate compared to a £3000 loan.

You may get it despite a very poor credit score or heavy debts. It does not involve much scrutiny. Instead, you may get the loan by just revealing a valid income and a bank account. However, don’t worry if you lack a personal account. You can still get pound 2000 as doorstep loans anytime. You get the cash delivered to your home/office or the desired place.

5000-pound loans

Unlike £2000, you can use the loan for slightly costly repairs, replacements, bills, and purchases. For example, you can use it to counter wedding expenses and home renovation, like bathroom caulking. You get a longer repayment term with a 5k pound loan compared to amounts less than this. Similarly, the credit enquiries and the assessment could be slightly stricter for a 2000-pound loan. You may need a fair credit history with no recent debt to qualify.

10000-pound loan

Sometimes, you need a little more flexibility despite bad credit or other financial issues. For example, you need to pay the rent deposit but lack the complete amount. Usually, you must pay 3 months' rent in advance. If the monthly rent is £7000, you must pay £21000 as the deposit. Most landlords demand it as security. If you have only £11000 in savings, £10000 pound loans may help you bridge it.

So, whether you need urgent cash to get instant medical care for a burn or pay the credit card bill at the last minute, contact us. We help you by understanding your needs and financial concerns. Our efforts to ensure the just-right, affordable, and manageable loan module eliminate stress. We do not restrain our offering. Unemployed with a basic income may also qualify.

No, you don’t always need a guarantor to qualify. Individuals with consistent income, fair credit history and well-managed payments may get a loan without one. Moreover, you may get better flexibility on a 3k pounds loan with no guarantor requirement and hassle.

You can choose the repayment tenure and the monthly payments to make and reschedule if you cannot pay. Thus, managing a loan without a guarantor is easy. Alternatively, if you don’t earn or lack a credit history, you must provide a guarantor.

Apart from having a verified income, you must meet other basic requirements. Here is who may qualify for the loan:

Taking 10K pound loans for five years grants flexibility over repayments. It reduces your monthly instalments and helps you budget wisely. You never miss important payments and budget for the dues easily. Moreover, fixed loan instalments ease the deal for you. Other benefits of extending the loan terms are:

The possibility of repaying the dues early depends on your affordability. It means that you can clear the loan within 6 months instead of 12 months loan, according to the loan agreement. It helps you save money on interest payments and helps you get debt-free. Here is what to consider before paying the loan early:

No, a loan of 4000 pounds does not hurt your credit score at the time of loan application. Instead, you may get the loan without a detailed credit assessment. We provide a quick quote after your basic application. It is known as a no-credit-check process. You can either ignore it or proceed with the approximate quote. The final quote you get after a detailed credit assessment may differ from this. It also does not impact your credit score.